crypto tax calculator australia

There are cloud-hosting tools specifically designed for crypto miners. Then sell it for 8000 two months later.

![]()

Cointracking Crypto Tax Calculator

Youre viewed as a crypto trader by the ATO as its your main source of annual income.

. When calculating your capital gain you can use two methods. Further 2 Medicare levy tax on income of AU70000 comes to AU1400. Youll then pay 19 tax on the next 26799 of income and finally 325 tax on the final 5000 of income - or roughly 6717 in total.

Get started JOIN COINPANDA Sign up for free Calculate your taxes in under 20 minutes. Up to 500 USDT in bonuses for new users Trade Anytime Anywhere. It is possible for you to pay capital gains taxes at your normal income tax rate of 10 to 37 if you hold your cryptocurrency fewer than one yearFor transactions held over a year capital gains taxes are paid at 0 15 or 20 rates over the long term.

The market value method or the cost base method. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly. Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly.

Top criminal tax and financial crimes. 19 tax on income between AU18201 to AU45000 which come to AU5092. You made 50000 throughout the 2021 - 2022 financial year.

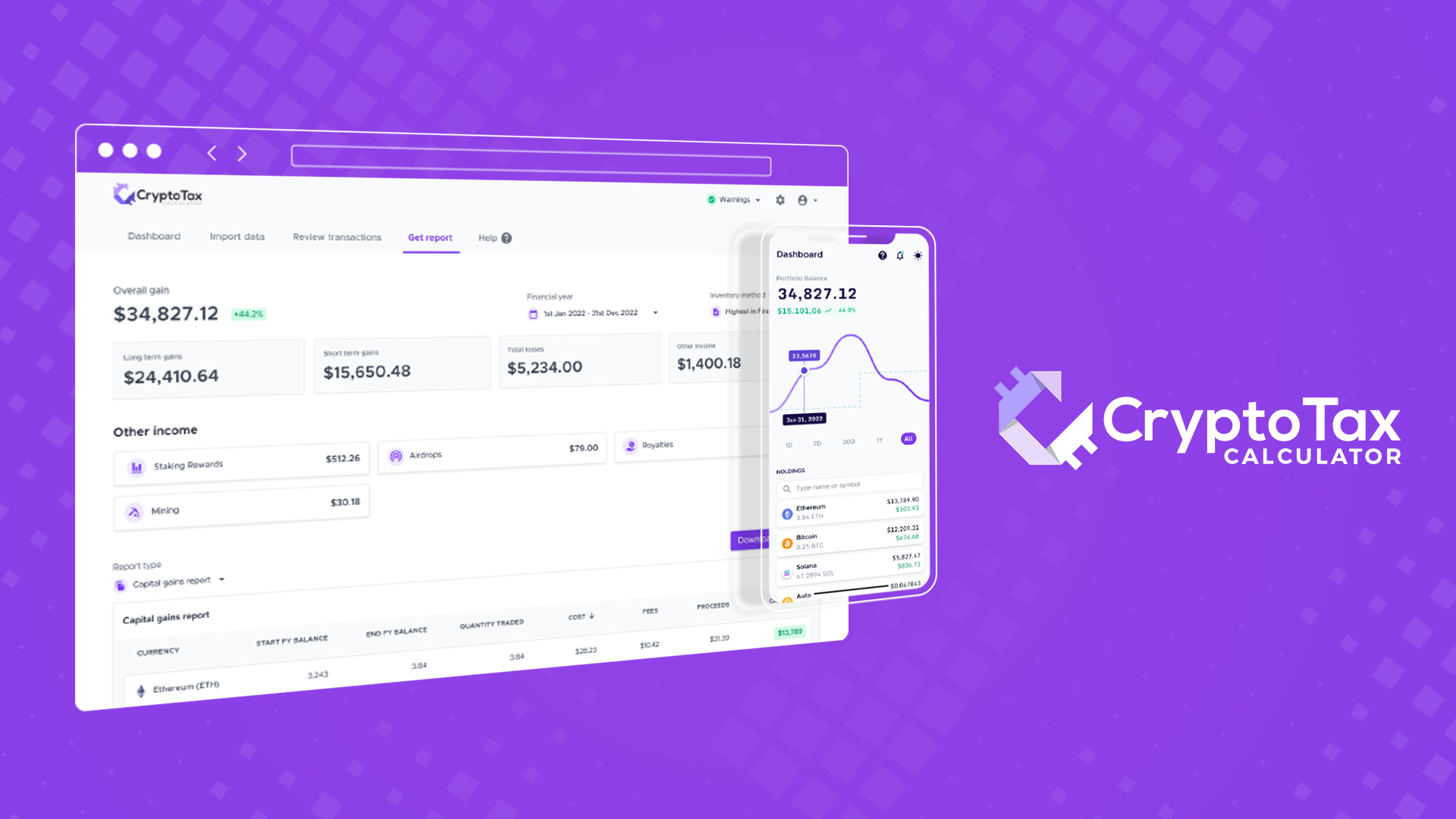

Here is a list of things you need before you lodge your crypto tax return with Etax. CryptoTaxCalculator The most accurate crypto tax software solution for both investors and accountants. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

You buy another Bitcoin for 10000. It has full integration with popular Australian exchanges wallets to import your crypto. This is the amount you are liable for on your short-term gains tax.

We use this to. Well Crypto Tax Calculator Australias plans and pricing are extremely affordable and versatile so you can choose the plan that works best for you based on your trading history. Blox free Pro plan costs 50K AUM and covers 100 transactions.

Koinly or Crypto Tax Calculator This report shows your profitloss and capital gains for the financial year. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting.

Check out our free and comprehensive guide to crypto taxes in Australia. How Is Crypto Tax Calculated. The market value is the price you sold it while the cost base is the price you acquired it.

Powerful Accurate Tax Reports. Thats just over 4 a month for your peace of mind when it comes to crypto tax in Australia. Crypto Tax Calculator for Australia NZ Crypto Tax Calculator for Australia Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance Capital gains report Miningstaking Income report Free tax preview Start for free See our 500 reviews on Did you receive a letter from the ATO.

Your first 18200 of income is tax free. 2019 - 2022 Crypto_Tax. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader.

In Australia youll pay Capital Gains Tax and Income Tax on your crypto investment. The value of the cryptocurrency is calculated in Australian dollars AUD at the time of the transaction. Their plans start at only 50 per year on a subscription basis.

Direct support for over 400 exchanges wallets DEXs and DeFi protocols. Blox supports the majority of the crypto coins and guides you through your taxation process. You make a capital gain of 5000 on your first transaction.

Current proceeds are 13000. How Much Are You Taxed On Crypto Australia. A record of all crypto purchases sales and interest earned.

Proceeds - Cost Basis 1000 Profit. The money involved appears to have affected investors across the globe including crypto buyers in the US the UK the Netherlands Canada and Australia. Simple fast reports Accurate and complex calculations Affordable plans FREE TRIAL Free trial 0.

Total income tax will be AU5092AU8125 AU13217. Thats a capital loss of 2000 on the second transaction. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king.

Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. The percentage of Capital Gains Tax youll pay is the same as your personal Income Tax rate starting only from earnings above 18201. Crypto Tax Calculator Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax.

Ad Find the Next Crypto Gem on KuCoin1 Out of 4 Crypto Holders Worldwide Is with KuCoin. Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of income. Our platform performs tax calculations with a high degree of accuracy.

Australia only Free report preview ATO friendly tax reports START FREE TRIAL Accountant Approved. This is the amount you are liable for on your long-term gains tax. Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale.

Sold LTC worth 12000 for 13000 after more than a year. If you hold for a year youll pay 50 less capital gains tax on crypto gains. Ideally you should download a crypto tax report from your provider.

As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space recently told DMARGE crypto is. You would only be subject to pay Capital Gains Tax on 3000 as opposed to 5000. Simply copy the numbers into your annual tax return.

5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case.

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax Calculator Review May 2022 Finder Com

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency

Bitcoin Price Prediction Today Usd Authentic For 2025

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Best Crypto Tax Software 10 Best Solutions For 2022

Crypto Staking Rewards Calculator Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips

How To Calculate Crypto Taxes Koinly

![]()

Cointracking Crypto Tax Calculator

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency

Koinly Crypto Tax Calculator For Australia Nz

Convert Bitcoin To Aud Cashout Bitcoins To Australian Dollars Buy Cryptocurrency Bitcoin Cryptocurrency

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

Free Crypto Tax Calculator 2022 Online Tool Haru